Last time, I casually wrote a short article for my WeChat official account titled The Localization of Pressure Sensors Is a Top Priority, which caused quite a stir among friends in the industry. Today, I’m taking the time while waiting for my flight at the airport to write this second piece for everyone to discuss.

My one-and-a-half-day trip to Tianjin was a busy one, with half a day of meetings and an evening discussion session yesterday. I could feel that the leaders of the Tianjin Municipal Party Committee and Municipal Government take a very pragmatic approach to the development of the Internet of Things (IoT) industry—specifically, how IoT can empower manufacturing and smart applications in various fields—and to investment promotion. There were only over 40 participants from other cities, yet two members of the Standing Committee of the Municipal Party Committee met with us separately for discussions in the afternoon and evening. This fully demonstrates Tianjin’s emphasis on IoT investment promotion. In the afternoon and evening, entrepreneurs from Beijing and Shanghai held targeted discussions with leaders of Hexi District respectively. The two key leaders also invited the Shenzhen IoT Association to host an IoT exhibition in Tianjin, envisioning a future with two major national IoT exhibitions—one in the south (Shenzhen) and one in the north (Tianjin).

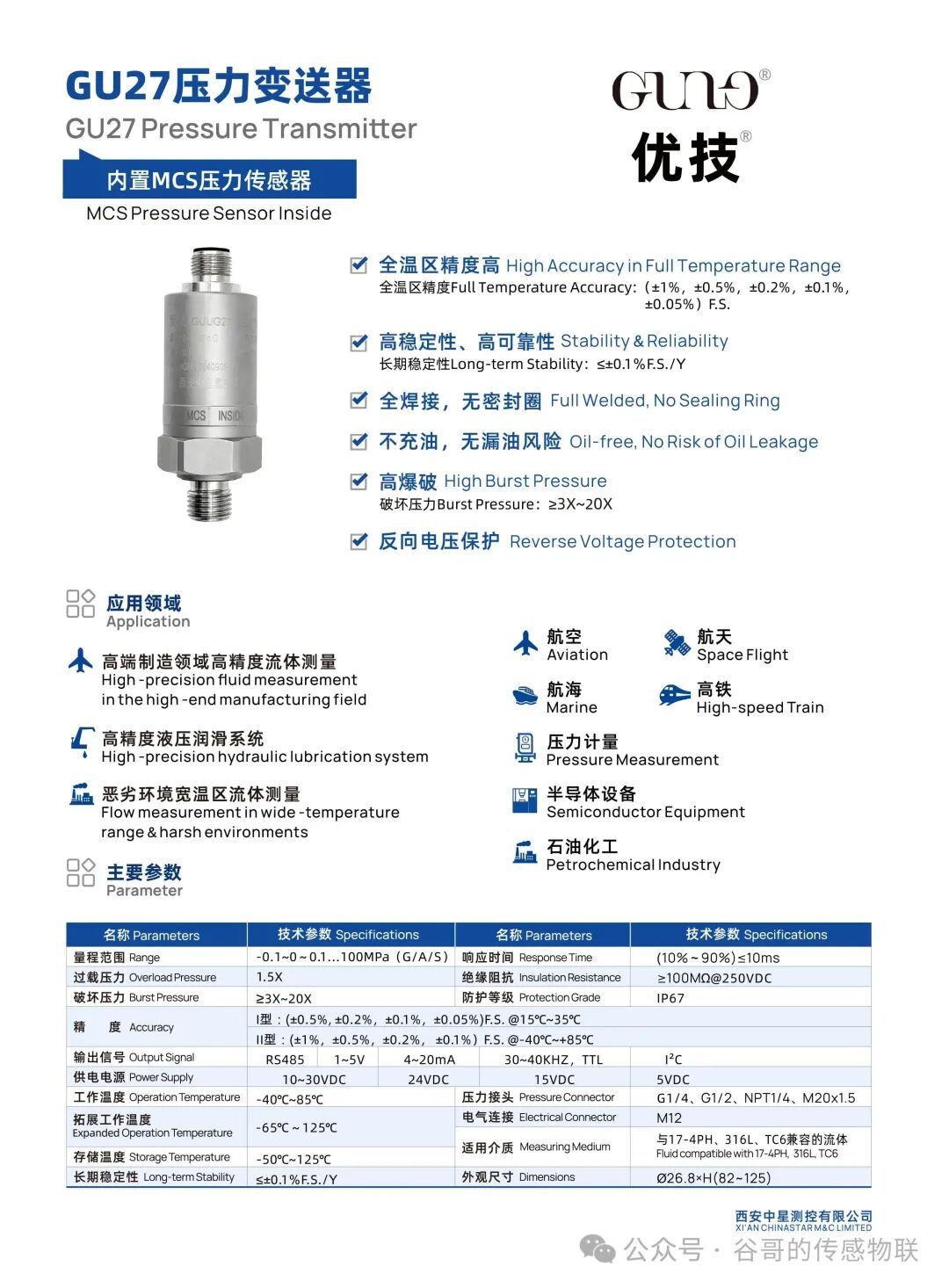

Today, I had a nearly three-hour chat with a technical expert friend from a foreign-invested sensor company in Tianjin. The main topics centered on the localization of pressure sensors in China and how Chinese pressure sensors can expand into high-end markets and high-end applications. We also talked about suggestions and expectations for our Chinastar M&C’s original MCS high-end pressure sensors.

MEMS pressure sensors are currently the most popular type of pressure sensors in China. There are dozens of companies capable of manufacturing oil-filled sensor cores, with nearly 10 alone in Shaanxi Province. However, none of them can produce high-quality cores for pressure ranges below 35 kPa, so many applications still have to rely on imported products. Going a step deeper, most of these dozens of oil-filled core manufacturers purchase their wafers from overseas; very few can independently design and produce wafers. Taking it even further: Are the raw materials for 4-inch, 6-inch, 8-inch, or even 12-inch wafers used in production made by domestic manufacturers? This brings to mind the question that Mr. Xu, the former president of the Shenyang Institute of Technology, has been advocating for years: When will China’s pressure sensor industry solve the problem of having the “device” but lacking the “core”?

Pressure sensors made using the glass micro-melting process also face the same issue with MEMS wafers. That said, several domestic enterprises have at least solved the glass micro-melting problem—specifically, the process of bonding MEMS wafers to metal through glass sintering. This is undoubtedly a significant progress.

In terms of ceramic piezoresistive and ceramic capacitive pressure sensor cores, China has made considerable advancements. For ceramic capacitive pressure sensor cores, Shenzhen Anpeilong has truly solved the technical challenges, and now produces them in large quantities for practical applications, especially in the automotive industry. This should be regarded as a major breakthrough in China’s pressure sensor sector. However, so far, there are no domestic manufacturers that can produce ceramic capacitive pressure sensors with the same high precision as Germany’s E+H. There are also over a dozen domestic companies producing ceramic piezoresistive sensors, but large-scale applications—especially those requiring millions of units—have not yet been seen.

That said, I (Brother Gu) am not certain whether the ceramics used for ceramic cups (likely a reference to ceramic substrates) and ceramic pastes required for these sensors have truly achieved localization.

As for the sputtering film process—mainly used for high-pressure range pressure sensors—domestic development has advanced significantly in recent years. In total, there are nearly 10 domestic manufacturers producing such sensors. Military-industrial enterprises have well-established production lines, but they have not yet solved the problems of low cost and civilian application. Private enterprises have invested in R&D for sputtering film technology, with particularly notable progress in Hunan Province. However, issues such as long-term stability and large-scale application still need to be addressed. It is worth acknowledging that this is also a major step forward. Similarly, I (Brother Gu) am unsure whether the materials used in the sputtering process have truly been localized.

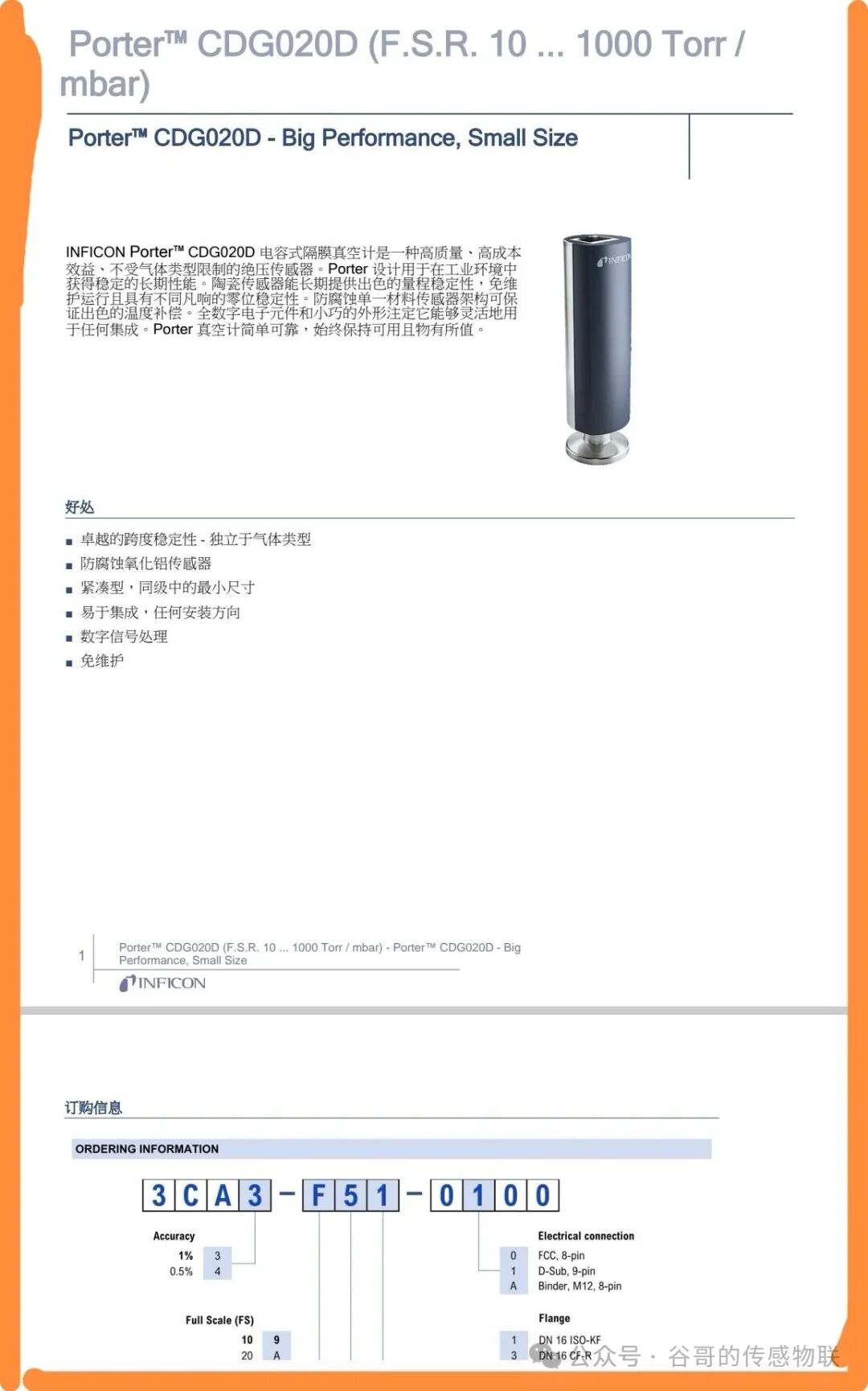

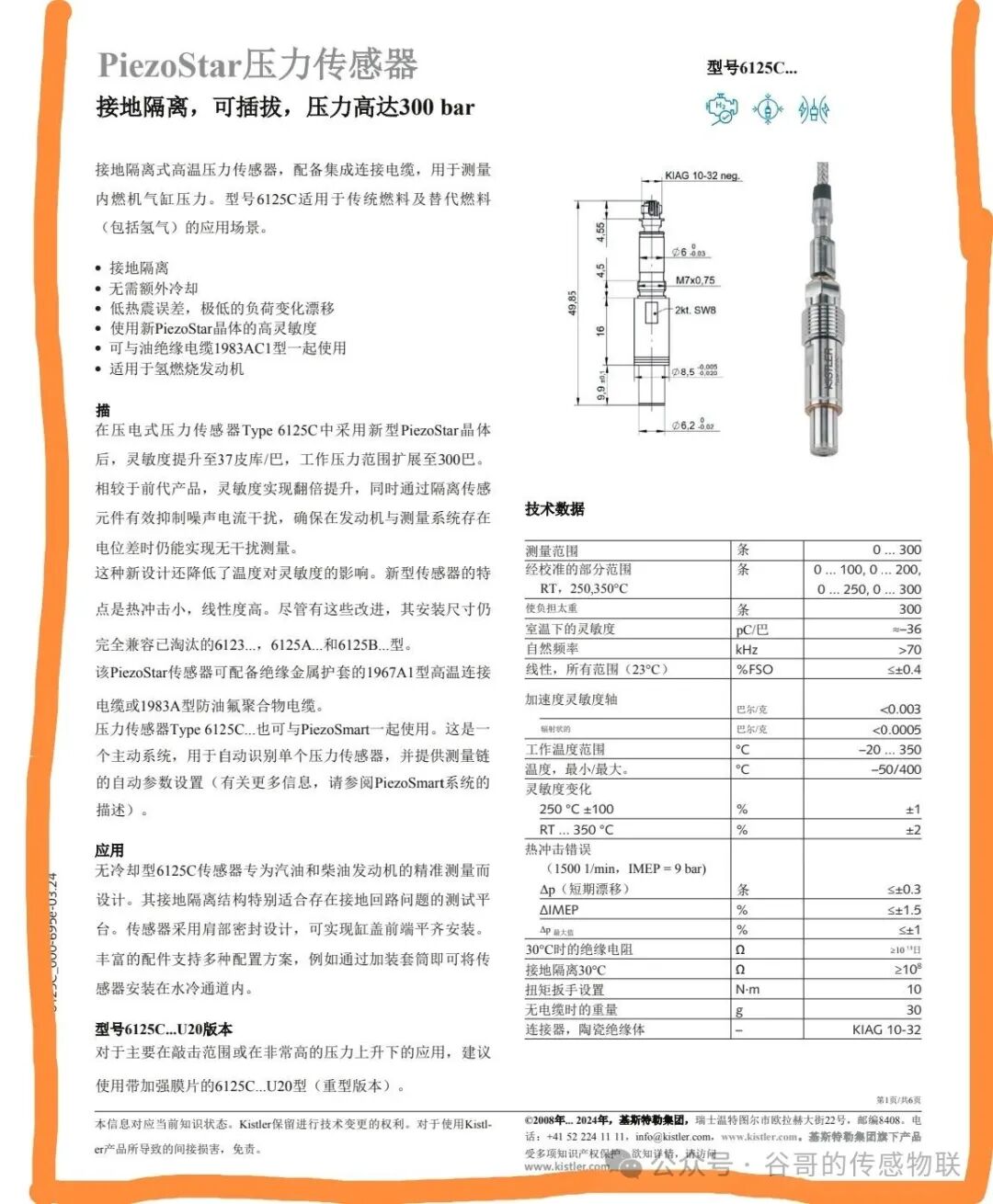

During our chat, some friends reached out to me via WeChat asking if I had access to certain types of sensors. For example, there is a low-pressure vacuum silicon pressure sensor (as shown above) used in the semiconductor industry, with a pressure range of 1000 Torr. Our MCS technology should be capable of producing it, but we have not yet resolved the issue of upgrading the process environment, which requires additional investment. Any Chinese company that can produce such sensors is welcome to contact me (Brother Gu). Another example is the high-frequency-response, high-temperature pressure sensor (also shown above). In fact, high-temperature sensors have always been a challenge for Chinese pressure sensor companies, and adding high-frequency response makes it even more difficult. Companies capable of producing such sensors are also welcome to contact me personally.

I suspect few people know exactly how many pressure sensor manufacturers there are in China. Back in 2019, when I (Brother Gu) personally wrote the White Paper on China’s Industrial Pressure Sensors, the statistics showed there were only 800 domestic companies producing industrial pressure sensors. However, at that time, we did not account for many enterprises that do not include “sensor” in their names but actually produce sensors; in addition, some state-owned research institutes could not be included in the statistics due to strategic considerations. Despite the large number of companies, they suffer from severe homogenization: for products that everyone can produce, there is cut-throat price competition; for products that no one can produce, few are willing to invest in R&D—instead, they wait for others to make the investment so they can copy the technology. This is indeed regrettable. With the ongoing Sino-foreign technological competition, this is a problem that Chinese enterprises must resolve.

I am often asked: Are there any Chinese pressure sensor companies that can replace the U.S.-based Kulite, Endevco, or PCB? (These foreign companies specialize in small-size, high-frequency-response sensors.) I am also frequently asked: Are there any Chinese sensor companies that can replace the pressure sensor cores made by Japan’s Yokogawa or the U.S.’s Rosemount? (These are known for high precision, high stability, and high reliability.) Others have asked about sensors capable of withstanding 1500 MPa, or pressure sensors that can operate continuously at 1800°C or even 3000°C.

Honestly, I don’t have good answers to these questions.

Our company, Xi’an Chinastar M&C, has spent nearly 10 years developing just one type of pressure sensor based on MCS technology. We hope this technology can address the needs for: high precision (up to 0.02% full scale); relatively high temperatures (currently up to 180°C); large pressure ranges (theoretically up to 1200 MPa); low temperatures (down to -70°C); and small pressure ranges (currently as low as 50 kPa). If you have business needs in these areas, we welcome you to collaborate with us for joint research and mutual progress.

The boarding call has started, so I’ll wrap up today’s WeChat official account essay here.

# 2025.09.17 17:48 Tianjin Airport #

Release Date:2025-09-18

Release Date:2025-09-18  Click on the quantity:2158

Click on the quantity:2158