October 25th News, Will Semiconductor Co., Ltd. disclosed its third-quarter report. In the first three quarters of 2024, the company achieved an operating income of 18.908 billion yuan, registering a year-on-year increase of 25.38%. The net profit reached 2.375 billion yuan, a year-on-year surge of 544.74%. The basic earnings per share was 1.98 yuan.

The year-on-year increase in net profit during the reporting period was mainly attributed to the further recovery of the consumer market and the consequent growth in demand from downstream customers. Along with the company's successful product introduction in the high-end smartphone market and the continuous penetration of autonomous driving applications in the automotive market, the company's operating income witnessed significant growth. At the same time, due to factors such as product structure optimization and effective cost control, the company's product gross margin gradually recovered. During the reporting period, the company's comprehensive gross margin stood at 29.61%, an increase of 8.33 percentage points year-on-year. Small financial note: The net profit in Q2 was 809 million yuan. Based on this calculation, the net profit in Q3 increased by 24.6% quarter-on-quarter.

China's leading sensor semiconductor supplier will narrow the technology gap and seize market share from global sensor suppliers.

Will Semiconductor Co., Ltd. was established in 2007. Initially, it was mainly engaged in the semiconductor design business of power devices and power ICs. In 2013, it acquired Beijing Jinghongzhi and Hong Kong Huaqing and ventured into semiconductor distribution business (wholesaler).

In 2019, it acquired Beijing OmniVision, Superpix Microtechnology Co., Ltd., and Vision IC Source. Among them, OmniVision is a top-three global CIS (visual image sensor) company with strong technical strength and a wide range of rich products.

In 2020, it acquired the TDDI business of Synaptics Asia, a well-known American enterprise. Thus, the company formed a 3+N product layout model consisting of image sensors, touch displays, and analog solutions.

From 2022 to 2023, the company made efforts in analog solutions. It increased its holdings in Beijing Junzheng Microelectronics Co., Ltd. and acquired Signaltech to expand its in-vehicle analog and memory chip business and enhance the territory of analog solutions.

Regarding Will Semiconductor's growth performance in the first half of this year, in the first half of 2024, the company achieved an operating income of 12.091 billion yuan, a year-on-year increase of 36.50%. The image sensor solution business generated sales revenue of 9.312 billion yuan, accounting for 77.15% of the main business income, an increase of 49.90% compared to the same period last year. The analog solution business also achieved remarkable results, with sales revenue of 634 million yuan, accounting for 5.25% of the main business income, a year-on-year increase of 24.67%. However, the display solution business declined, with sales revenue of 472 million yuan, accounting for 3.91% of the main business income, a year-on-year decrease of 28.57%.

According to Technologysights statistics, in the global mobile phone CIS market in 2023, Sony occupied 55% market share, Samsung accounted for 25%, and Will Semiconductor ranked third with 13%. It is the largest image sensor company in China and the third largest in the world, and also the largest sensor enterprise in China. Currently, Sony is the main mobile phone CIS supplier for Apple. Samsung mainly supplies itself. Will Semiconductor is mainly targeted at the Android mobile phone market other than Samsung, including domestic mobile phone brands such as Huawei, Honor, Xiaomi, and vivo.

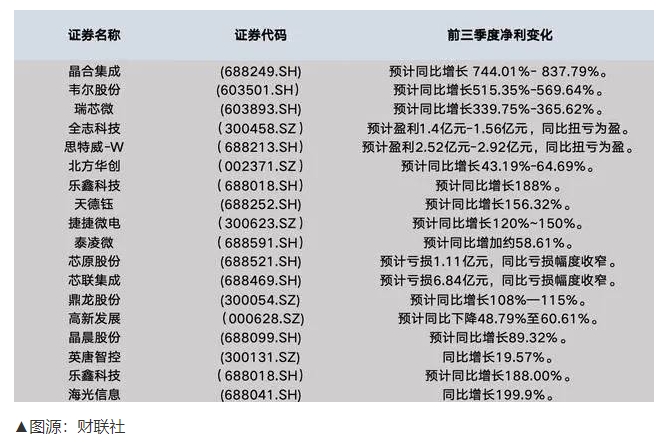

In addition to Will Semiconductor, the performance of other domestic semiconductor manufacturers also shows a recovery trend. According to incomplete statistics by reporters from Cailian Press, as of the close of trading on October 22nd, at least 18 A-share semiconductor companies have announced their 2024 first three-quarter performance forecasts or reports. Among them, only one company's net profit decreased year-on-year, while the net profits of the remaining companies all increased, turned from losses to profits, or narrowed the loss range.

However, it is worth noting that with the end of the peak season for consumer electronics stocking in Q3, the crazy growth of the semiconductor industry may come to an end.

According to the "2025 Sensor Market Outlook" report released by the well-known consulting agency TechInsights, in 2025, demand from mobile devices and advanced driver assistance systems (ADAS) will continue to drive the growth of image sensors (CIS):

Mobile devices drive image sensor revenue growth

The expansion of high-resolution, large-pixel and large-size sensors is booming, creating a strong position for mobile CMOS image sensors (CIS) products in the customer supply chain. Moreover, higher average selling prices will further fuel the growth of image sensor revenue.

ADAS demand drives CIS applications

To improve the performance of ADAS systems, cameras must rely on automotive-grade image sensors. ADAS demand directly influences sensor adoption. Image sensors with higher resolution, high dynamic range (HDR) and LED flicker mitigation (LFM) functions are expected to see strong demand in forward ADAS and surround view camera applications.

TechInsights predicts that China's leading sensor semiconductor suppliers will narrow the technology gap and seize market share from global sensor suppliers.

Release Date:2024-11-06

Release Date:2024-11-06  Click on the quantity:2352

Click on the quantity:2352